The Wells Fargo 2025 settlement marks a significant development in addressing the bank’s history of fraudulent practices. Affecting approximately 16 million accounts, this settlement is one of the largest banking resolutions in recent history, aiming to compensate affected customers and restore trust in financial institutions. Here, we’ll explore the settlement details, payout amounts, eligibility criteria, and next steps for affected customers.

What Led to the Wells Fargo Settlement 2025?

The Wells Fargo settlement stems from years of allegations involving unauthorized account openings, excessive fees, and discriminatory loan practices. These actions caused significant financial harm to customers, prompting lawsuits and regulatory scrutiny. Notable events include:

- 2016: Wells Fargo was found to have opened millions of unauthorized accounts to meet sales targets.

- 2020: A class-action lawsuit was filed, accusing the bank of false and misleading statements from 2018.

- 2024: The bank agreed to a $1 billion settlement to resolve claims involving fraudulent practices, including wrongful auto loans, unauthorized fees, and improper loan processing.

The settlement addresses various claims, with compensation amounts varying based on the type of harm suffered.

| Auto loan repossession | Up to $4,000 per individual |

| Unauthorized fees | Compensation based on violation severity |

| Wrongful foreclosures | Share of $77.2 million among ~3,200 customers |

| Other account-related issues | Amounts determined case-by-case |

The total settlement amount will include deductions for taxes, litigation expenses, and court fees, ensuring fair distribution among eligible customers.

Eligibility Criteria

To qualify for compensation, individuals must meet specific criteria:

- Held a Wells Fargo account between 2011 and 2022.

- Experienced unauthorized account openings, excessive fees, or wrongful foreclosures.

- Provide evidence, such as bank statements, loan agreements, or foreclosure notices, demonstrating the impact of Wells Fargo’s practices.

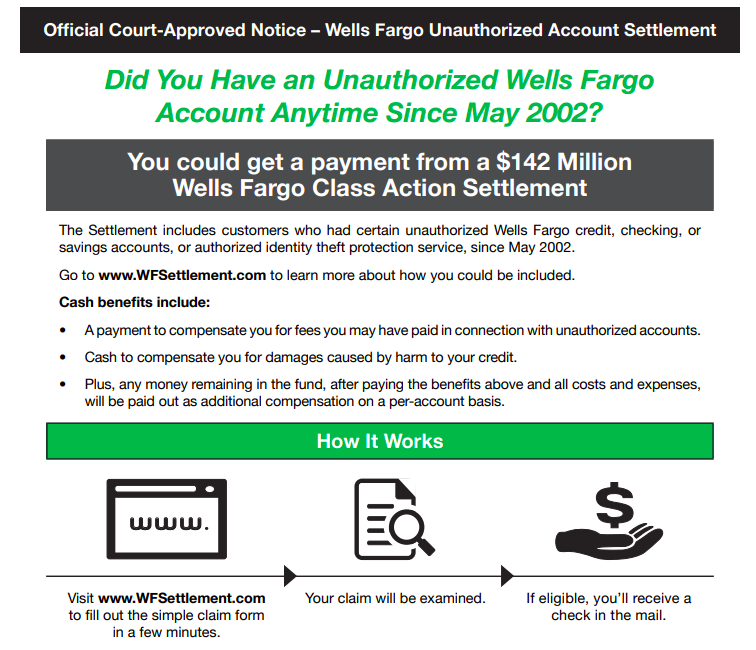

Filing a Claim: Step-by-Step Guide

Affected customers should follow these steps to file a claim and receive compensation:

- Review the settlement criteria to ensure your case qualifies.

- Collect relevant records, such as account statements or proof of wrongful practices.

- Access the settlement portal at www.wfsettlement.com for claim forms and additional information.

- Provide detailed information about the issue and submit the required documentation.

- Ensure accuracy and file the claim before the specified deadline to avoid disqualification.

Timeline for Payout Distribution

While the court has not finalized payment dates, the settlement’s distribution phase is expected to begin in mid-2025 and could extend into early 2026. This timeline allows for proper verification of claims and ensures fair processing.

| Key Date | Event |

| November 9, 2020 | Class action lawsuit filed |

| January 2025 | Settlement finalized |

| Mid-2025 to Early 2026 | Payout distribution begins |

Broader Implications of the Settlement

The Wells Fargo settlement has far-reaching consequences for the banking industry, emphasizing the importance of accountability and consumer protection. Key lessons include:

- The case highlights the role of the Consumer Financial Protection Bureau (CFPB) in ensuring fair practices.

- It underscores the power of collective legal action in addressing corporate misconduct.

- Banks must adopt stricter internal controls to prevent similar issues in the future.

Next Steps for Affected Customers

If you believe you are eligible for compensation under the Wells Fargo settlement, take the following steps:

- Monitor updates from the official settlement website.

- Also, gather all relevant records to support your claim.

- Submit your claim before the deadline, this is a must do for the affected customers.